Overview: What are we talking about?

This guide offers a comprehensive, step-by-step process flow for successfully completing a cardONE application. By following these steps, you can ensure an accurate and efficient application process. Based on the information you have already provided, we have prepared an official application through CardConnect. This application is a standard form required for all new customers, which includes your rate-match information, contact details, and other essential particulars necessary for the opening of your merchant account. The application will need to be carefully reviewed and electronically signed before your account can be established. We have provided a step by step process to facilitate your completion of the application.

Helpful Hints: Before you begin

Recommended Browser: Chrome or Firefox via desktop verses mobile device

Option: In the event that you are unable to access the online application, kindly send us an email and we will provide you with a paper application for signature

Canadian business: PDF application is required and completing the following steps will not be necessary

Let’s Start: Digitally Sign the CardConnect Application

Email Origination address: donotreply@cardpointe.com

Option: Check your SPAM folder

NOTE: Please be aware that there is a "Sign My Application" button located at the bottom of this email. Upon clicking this button, you will be directed to the CardPointe website.

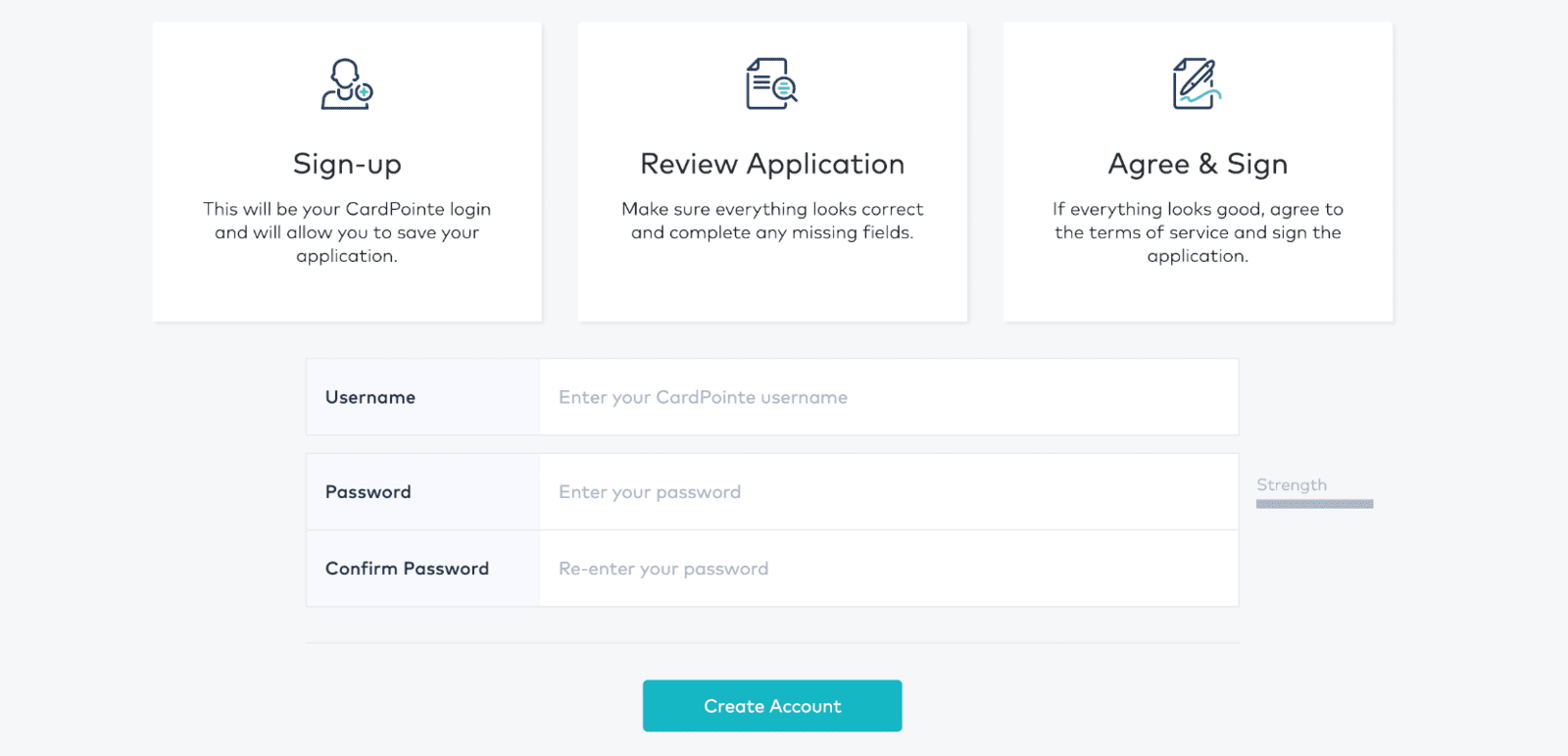

Creating an Account: You will be required to create an account at this stage. This account will serve the purpose of your application, as well as granting you online portal access to view statements and activity.

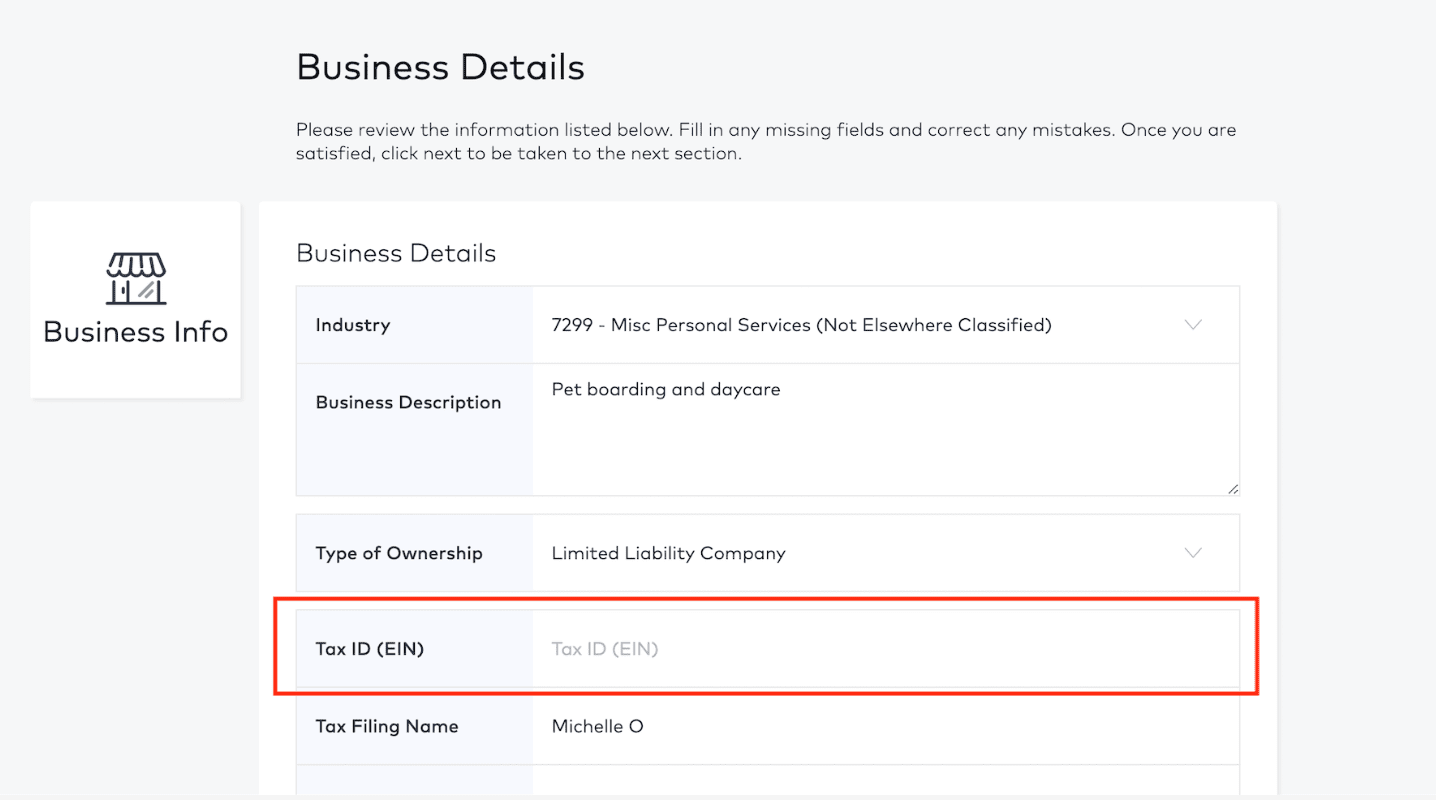

Business Details

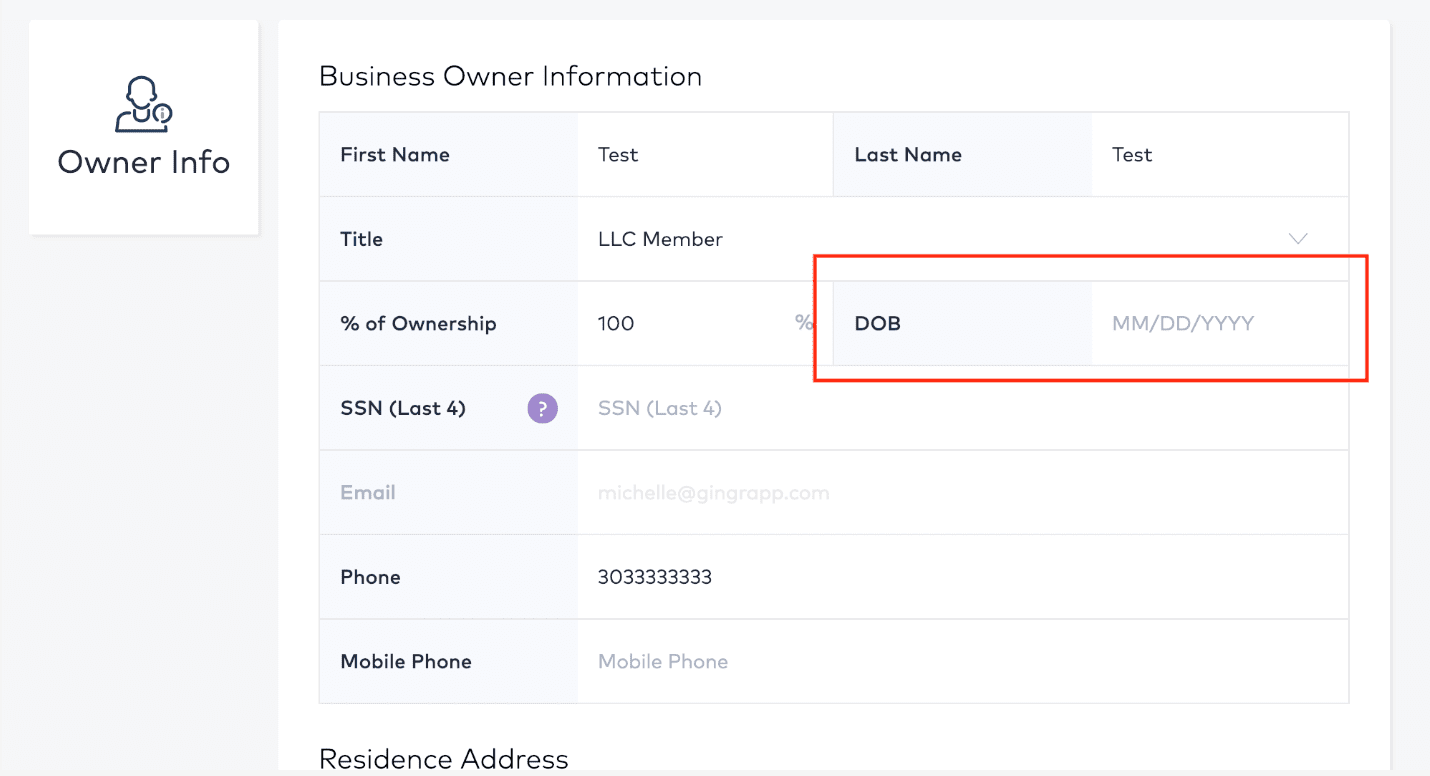

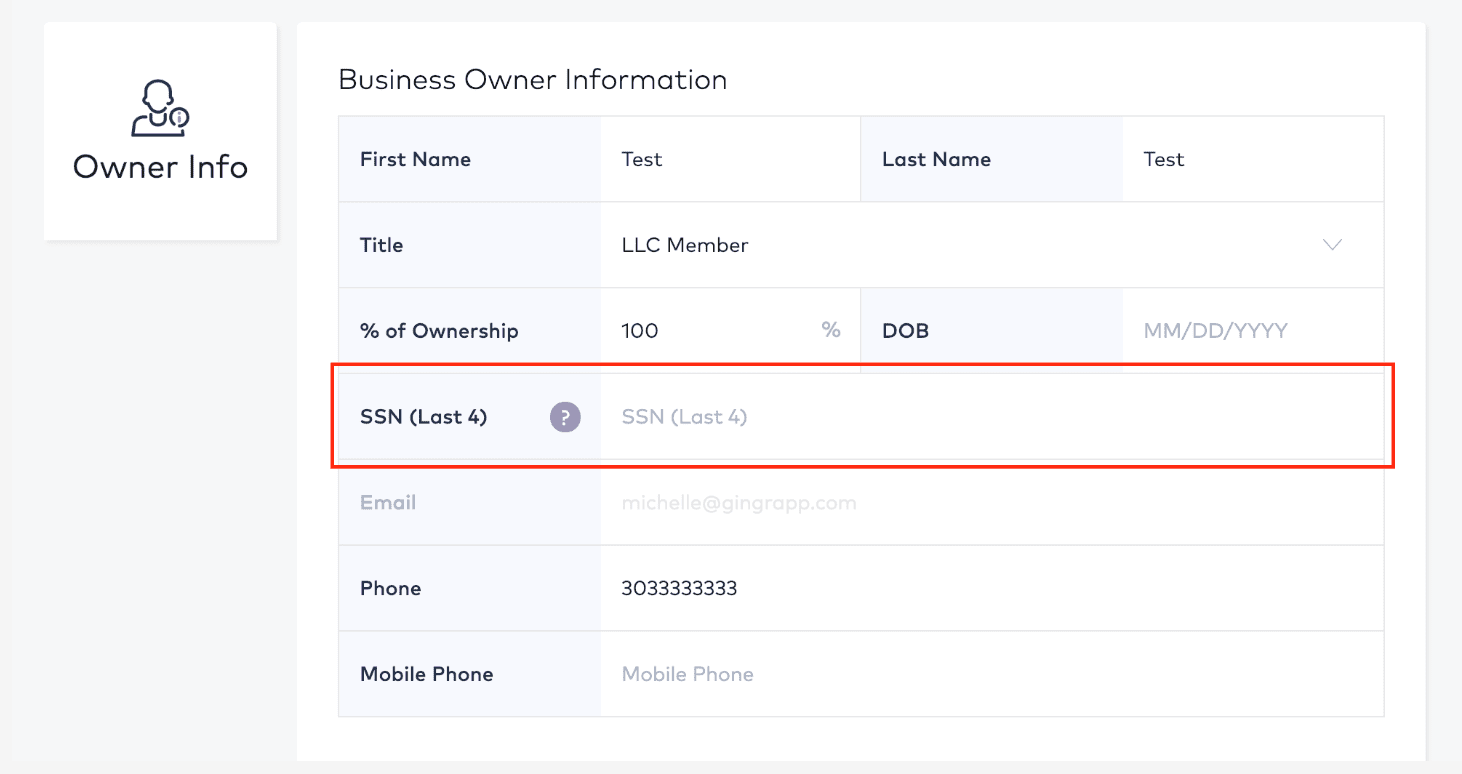

Upon successful creation of your account, you will be directly taken to your application page. Please note that we have already entered most of the necessary information on your behalf (kindly verify its accuracy). However, you will still need to provide the following details:

1. Tax ID:

2. Date of Birth (DOB):

3. Last 4-digits of your Social Security Number (SSN):

Once you have verified everything on this page, you will scroll down and click on Ok. Looks great, let's move on!

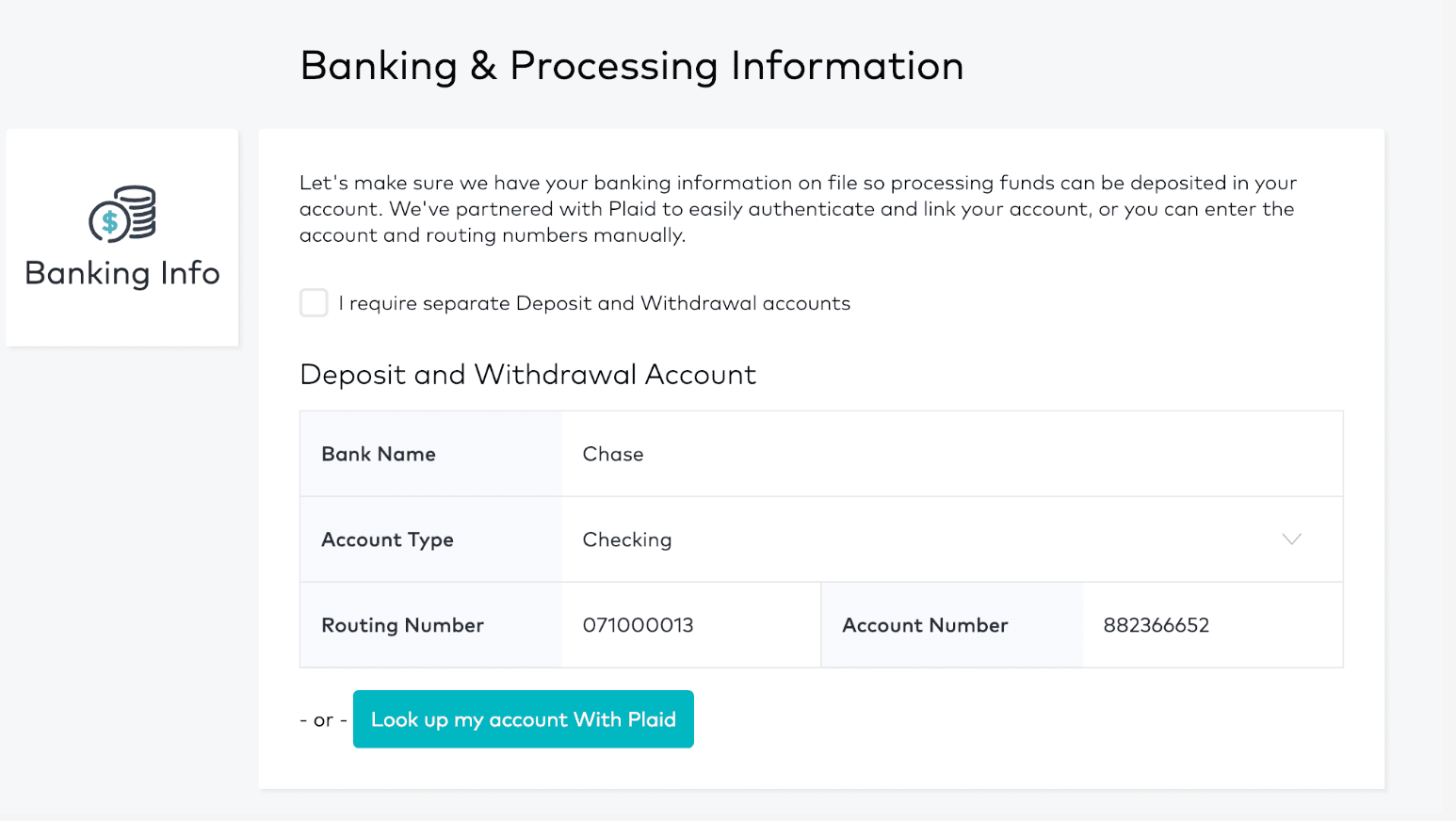

Banking & Processing Information

Next, you will be prompted to set up your Banking Information, which will be used for deposit purposes and deduction of processing fees.

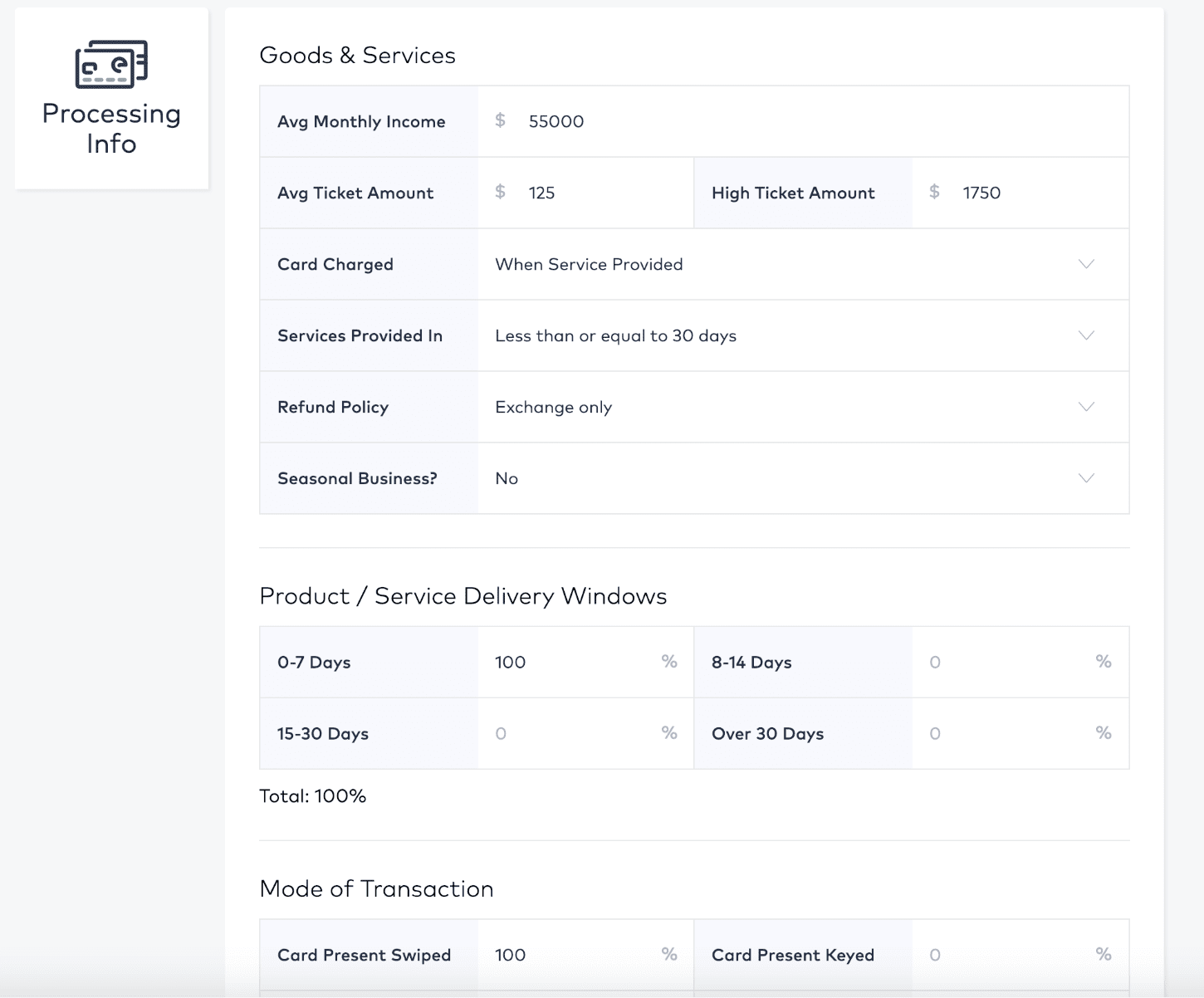

The subsequent section pertains to Processing Info. We have already taken the liberty of filling out this section for you, based on the statements you have previously provided us. Please contact us to initiate any changes. Do not alter this section as it can affect the approval process.

Upon reviewing the information, click on "Ok". If everything appears to be in order, we can move on to the next step. However, if you happen to come across any significant inaccuracies, please notify us immediately before making any changes.

Equipment

At this stage, you will be required to verify the equipment you have selected for this account. Ensure that both the Model and Quantity are accurate. If you notice any discrepancies in either of these details, kindly inform us before proceeding further.

Agree & Sign

Agree & Sign

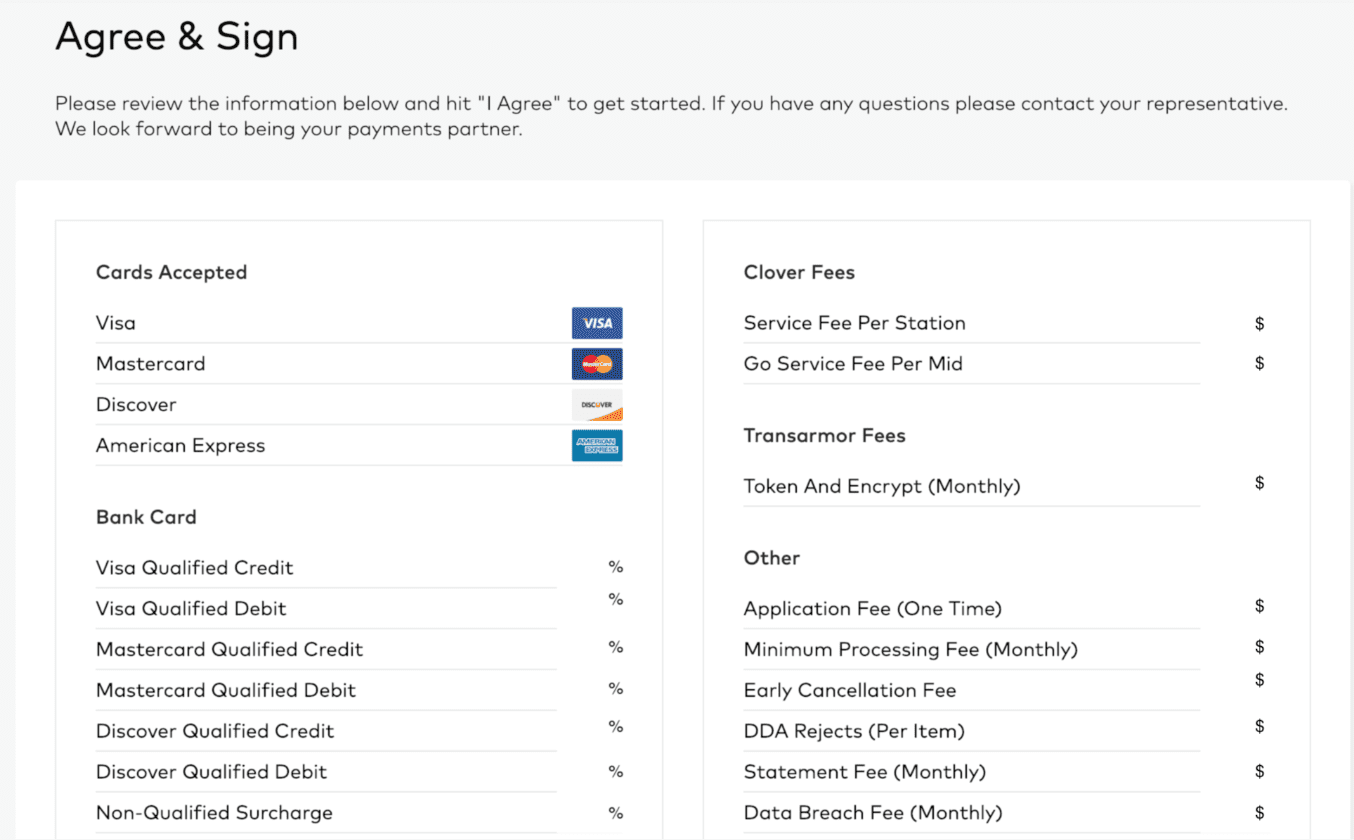

Subsequently, you will be directed to a page that lists all your rates and fees, itemized on a line-by-line basis. Upon verifying that the details are accurate, you may proceed to the next section of the page.

Note the following definitions regarding certain fees. Please be advise that these fees are usually incidental and are only applicable in specific situations.

- DDA Reject Fee - this is an insufficient funds fee if there aren’t funds in your account to cover the monthly processor fees.

- Chargeback Fee - this fee is only imposed when someone claims you did not provide the product or service you charged them for, or if a card is used fraudulently (a stolen card) and the real card holder claims not to have made the purchase. Very rare in our industry.

- Retrieval Fee - this fee is only implemented if you request records from the processor older than 18 months. You will never pay this as your can see your records in Gingr going back to the start of your account.

- PCI Non-Compliance Fee - you only incur this fee if you do not fill out the questionnaire and scan. We give you step by step instructions on how to remain compliant and avoid this fee. And you have 60 days after your account is approved to get it done, so plenty of time to avoid any fees.

- Early Termination Fee - note that this has been set to $0 (above) which overrides what is listed in the Program Guide (below)

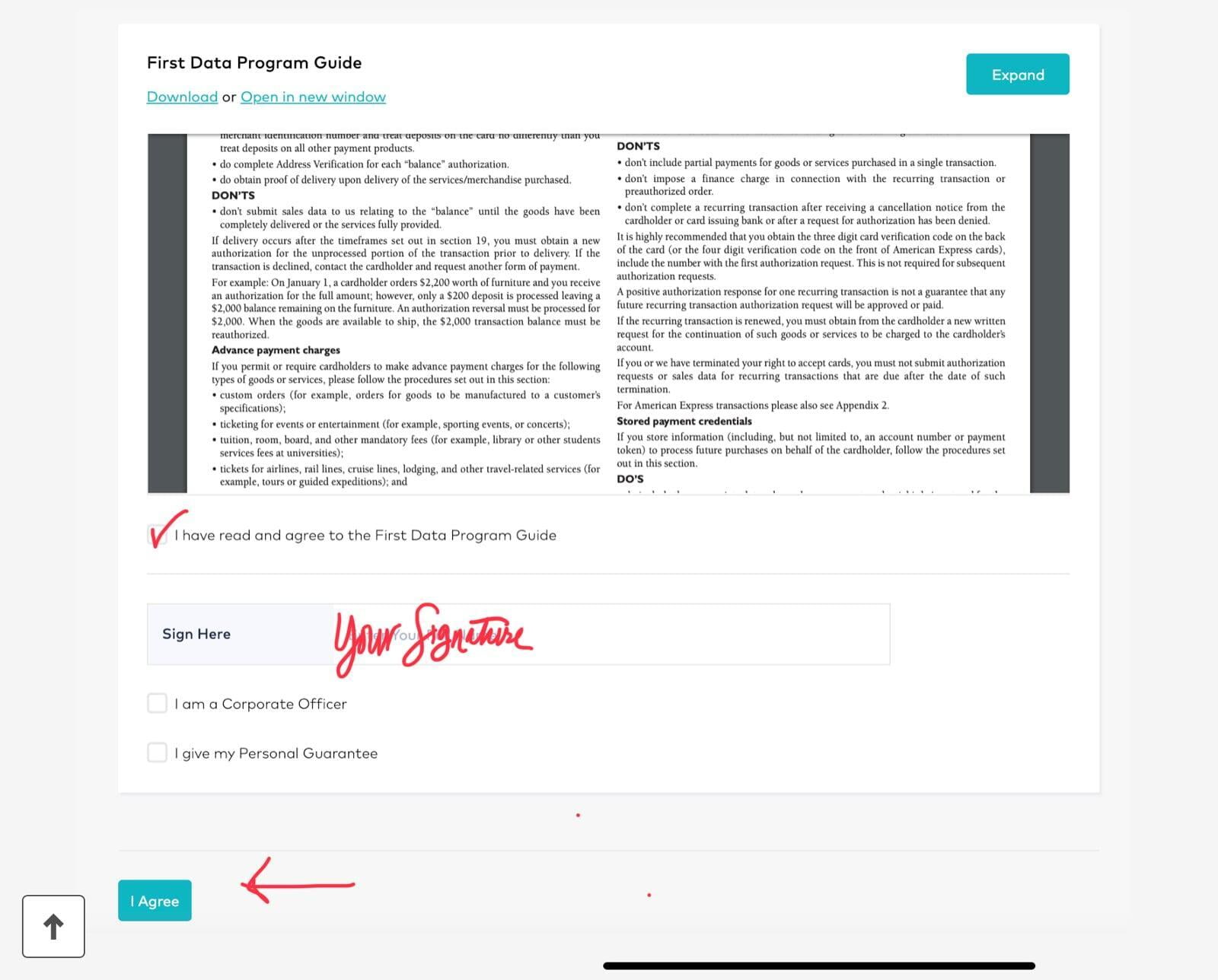

As you continue scrolling down, you will come across a copy of the standard First Data Program Guide, followed by three checkboxes and a signature box.

- You can download the First Data Program Guide for your records, and click the box that says I have read and agree to the First Data Program Guide.

- In the box that says Sign Here, you will need to type in your full name as it appears on the application.

- Check the first box that states I am a Corporate Officer and I give my Personal Guarantee.

- Then, click I Agree to electronically sign the application.

Upon clicking “I Agree”, you will be redirected to the main screen where your application will be displayed as "In Progress".

What's Next?

Upon submission, the approval process typically takes 1-2 business days, unless additional information is required. Once approved, you will receive an email from with the subject line "Your Application is Complete! Welcome to CardPointe." The email will include your Merchant ID (MID). Subsequently, your cardONE representative will contact you to discuss the next steps.